Live Assistance Via Zoom

Click here for Live Assistance during the hours below

Monday: 11:00am-12:00pm & 1:00pm-2:30pm

Tuesday: 11:00am-12:00pm & 1:00pm-2:30pm & 4:45pm-5:45pm

Wednesday: 11:00am-12:00pm & 1:00pm-2:30pm

Thursday: Closed

Friday: Closed

Most students (and parents) complete the application with assistance in less than 30 minutes.

Our goal is to help you finish the application in just one session! We take you step-by-step on how to get the money you need for tuition, textbooks and living expenses.

Video "How to navigate the financial aid portal"

“My parents make too much money, so I won’t qualify for aid.”

Reality

There is no income cut-off to qualify for federal student aid. Many factors—such as the size of your family and your year in school—are taken into account. Remember: when you fill out the Free Application for Federal Student Aid (FAFSA® ) form, you’re also automatically applying for funds from your state and possibly from your school as well. In fact, some schools won’t even consider you for any of their scholarships (including academic scholarships) until you’ve submitted a FAFSA form. Don’t make assumptions about what you’ll get—fill out the FAFSA form and find out.

WebGrants 4 Students Creating an Account

Tuition Savings. Moorpark College Promise

Tuition Savings Start with the Moorpark College Promise! You may qualify for Free tuition at Moorpark College even if you're not eligible for federal financial aid! It is called the Moorpark College Promise Program!

If you need help paying your enrollment fees and have not completed a FAFSA or California Dream Act Application(CADAA) you may apply for the California College Promise Grant (CCPG) available to California residents.

Moorpark College Federal School Code is 007115

Is it too late to apply for financial aid?

No! We strongly encourage you to apply today! If you need help, we're available virtually and in person to assist.

Additional Aid

Federal School Code: 007115

Additional financial aid is available to eligible students. Fill out the FAFSA for any additional assistance. Many students find out that they have more financial assistance when they fill out the FAFSA on time!

Students may receive federal financial aid from only one school during any given semester; however, if you attend a 4 year university and a community college you may be eligible to receive a fee waiver at the community college.

PAY FOR COLLEGE

Drop Process Timeline:

- The drop process for unpaid Spring 2026 fees begins on December 08, 2025.

For more details and assistance, feel free to contact the Student Business Office.

The Board of Governors of the California Community College system offers a fee waiver program for low-income residents of California that are attending a community college. The California College Promise Grant (CCPG) will waive all per-unit enrollment fees ($46 per unit) for an eligible student. If you need money to help with books, supplies, transportation and other costs, please complete a Free Application for Federal Student Aid (FAFSA) or the California Dream Application (for eligible AB 540 students). It's OK to file both a CCPG and a FAFSA. We will let you know if you qualify for an automatic FEE WAIVER. If you do NOT qualify using the simple online application method, you should file a FAFSA. Many, many students do not qualify under Methods A or B, but still qualify for a Method C fee waiver and additional financial aid by filing the FAFSA.

Apply now for a California College Promise Grant

To qualify for the California College Promise Grant [CCPG] Program, you must:

Be classified as a resident of California or be a non-California resident eligible for tuition exemption AB 540, or AB 1899 student by Admissions and Records, and for California resident homeless youth as determined by the Financial Aid Office.

If you have not had your California residency or eligibility status determined by the Admissions or the Registrar or homeless status determined by the Financial Aid Office, see one of those offices to obtain the determination. California College Promise Grant eligibility cannot be determined until your status has been verified.

Meet income criteria by:

- o Providing proof that you are receiving monthly cash assistance from TANF/CalWORKs, SSI/SSP or General Assistance (or, if a dependent student, your parent(s) receive this assistance) or

- o Establishing that your income (or your parent's income, if you are a dependent student) was within set income standards for the CCPG or

- o Completing a FAFSA (Free Application for Federal Student Aid) and have remaining financial need or

- o Being a Congressional Medal of Honor recipient (or dependent); being a dependent of a victim of the Sept. 11, 2001, terrorist attack; having certification from the California Department of Veteran Affairs or the National Guard Adjutant General; or being a dependent of a deceased law enforcement/fire suppression personnel killed in the line of duty that you are eligible for this waiver.

- Having documentation from the Department of Corrections and Rehabilitation that you've been exonerated of a crime by writ of habeas corpus or pardon.

- Having documentation of record that you're a dependent/spouse/Registered Domestic Partner of a deceased physician, nurse, or first responder who died of COVID-19 during the COVID-19 pandemic state of emergency in California.

California College Promise Grant Program Part B

These standards are based upon the federal poverty guidelines as published each year by the US Department of Health and Human Services. Under Title 5 of the California code of Regulations, the income standards for the program equal 150% of the federal poverty guidelines for the base year.

These standards are to be used to determine Fee Waiver B eligibility.

Tuition Savings. Moorpark College Promise

Tuition Savings Start with the Moorpark College Promise! You may qualify for Free tuition at Moorpark College even if you're not eligible for federal financial aid! It is called the Moorpark College Promise Program!

TO RECEIVE THE MC PROMISE, YOU MUST:

• Apply Now to Moorpark College

• Be a first year/first time student, enrolling and attending immediately after high school graduation

• Submit a FAFSA or Dream Act application each year.*Please note that beginning next year for the 2026-2027 cycle the deadline will be March 2, 2026 in alignment with the state priority processing deadline.

• Have Moorpark College on your FAFSA or CADAA (school code 007115) and enrolled full-time, 12 units or more for the spring 2026 term by November 25th, 2025.

• Be a California Resident or AB 540 Student from within our locally defined service area (established local education agencies/feeder schools to Moorpark College in Ventura or Los Angeles county( along the immediate 101 corridor).

• Have not previously earned a postsecondary degree or certificate

• Enroll full time at Moorpark College (12 units or more*). Maximum of 12 Moorpark College units per term and 24 per year.

• Complete all units for which the student was funded for continued eligibility.

*Moorpark Promise is limited and dependent upon available funding from state legislation.

*Eligibility criteria may change, and some exceptions may apply.

*DSPS/ACCESS exception with accommodation of 9 units.

*Funding limited to 12 Moorpark College units per term- if a student takes more, they will not be funded above 12 units per term and 24 units per year.

How do I register for classes?

- Check your VCCCD portal for registration appointment or contact Admissions and Records

How do I maintain my eligibility?

In addition to renewing your FAFSA or California Dream Act application each year and enrolling full-time (12 or more units) at Moorpark College, you must also meet the following Qualitative and Quantitative Standards at the end of each semester.

| Standard | Minimum Requirement |

|---|---|

| Qualitative Standard | A 2.00 minimum cumulative grade point average (GPA) in all coursework attempted. |

Grades-

In determining the above standards, grades of A, B, C, D, P, CR (Credit), or CRE (Credit by exam) are considered completed coursework. Grades of F, I (Incomplete), IP (In Progress), W (Withdrawal), EW (Excused Withdrawal), MW (Military Withdrawal), NC (No Credit), NP (No Pass), and RD (Record Delayed) are not considered completed coursework. All grades are considered attempted units.

Failure to meet these academic standards will result in cancellation and permanent loss of the MC Promise award.

What fees does the MC Promise Cover?

The Moorpark College (MC) Promise covers the cost of the per-unit Enrollment Fees.

How is the Moorpark Promise award applied?

The Moorpark Promise award will be applied to an eligible students pending balance after verification of full-time enrollment though the term census date. If student is enrolled in late start courses, funding will apply after course start dates, If student continues to meet all eligibility requirements. Funding will be applied as a grant award toward the students pending balance. Any excess funds will be refunded to the student. If the student no longer meets eligibility requirements, they will be disqualified from receiving the Moorpark Promise and would be responsible for covering any pending balance.

*Students will receive funding for 12 units at $46.00 per unit, totaling $552.00.

*Students are responsible for covering any additional units taken over 12, as well as student and materials fees, if any, associated with course enrollment.

*Students can deduct the award amount from their pending balance and make payment towards the difference. Payments can be made via e-payment or via the Moorpark Student Business office.

APPLICATION SEARCH

One application can lead to many scholarship opportunities.

To ensure your application receives full consideration, complete the application by answering as many questions as possible. The more information you provide, the more opportunities you have to be matched to various scholarships. Scholarship matches are based on the answers you provide on the questionnaire. Also, on the essay that will require a personal statement, information on community service, leadership, work experience, and financial need. You will need to provide an unofficial transcript, a letter of recommendation from a faculty member, counselor, administrator, employer, or co-worker. Scholarship Webpage

How do I receive a Direct Loan at Moorpark College?

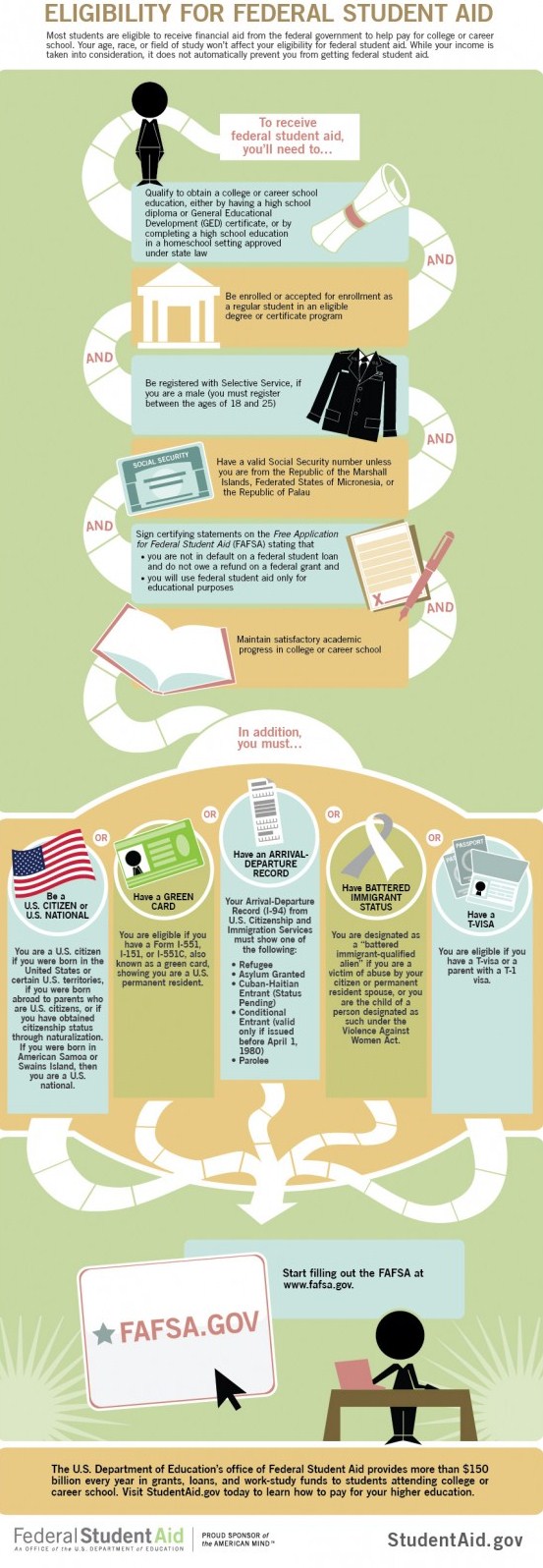

- Complete a Free Application for Federal Student Aid (FAFSA) online at www.FAFSA.gov for the school year you intend to enroll.

- Complete and/or submit all requested financial aid requirements as listed on your my.vcccd.edu portal.

- Receive an award notification email indicating that your financial aid file review is complete.

- Continue to meet the minimum Satisfactory Academic Progress (SAP) standards to ensure eligibility.

- Enroll in 6 or more degree-applicable units for an eligible Moorpark College program of study during the desired loan application period.

- Complete Direct Loan Entrance Counseling online at studentaid.gov/entrance-counseling.

- Complete a Direct Loan Promissory Note online at studentaid.gov/mpn.

Are there any other eligibility requirements?

Eligibility is not guaranteed. Applicants must meet all federal aid eligibility requirements. MC reserves the right to refuse to certify a loan under conditions established by 34.CFR 685.301. Borrowing the low-interest, Federal Direct Loan is a privilege. Some conditions for refusing to certify a loan to high risk borrowers include but are not limited to:

- The student is not making progress or enrolled in an eligible degree, certificate or transfer program at Moorpark College. This decision is made independently from the (SAP) Appeal process.

- The student has already borrowed the maximum loan amount appropriate for community college programs.

- The student appears to be or has been in default or delinquent on federal financial aid obligations.

- Notification of previously discharged federal student loans due to disability or bankruptcy.

- Instances of inconsistent, fraudulent FAFSA, or admissions application information.

- The student has a drastic change in requested borrowing amount from previous year(s).

- The student has valid and applicable education for employment and is choosing to pursue another educational endeavor. This decision is made independently from the SAP Appeal process.

YOUR RIGHT TO CANCEL ALL OR PART OF A LOAN

Cancelling or Reducing Your Federal Student Loan

Before your federal loan is disbursed, you have the right to cancel all or part of your loan by notifying the Financial Aid Office.

After disbursement, you may still cancel or reduce your loan through the following options:

- Notify Moorpark College within the school's cancellation timeframe.

Each term, Moorpark College sets specific deadlines to cancel or reduce loans after disbursement. To request a loan cancellation or reduction, please complete and submit our online form:

👉 Loan Cancellation/Reduction Request Form - Return funds to your loan servicer within 120 days of disbursement.

If you’ve already received loan funds, you can return all or part of the money within 120 days of the disbursement date. This will cancel that portion of the loan, and you won’t be charged interest or fees on the cancelled amount.

To proceed, contact your loan servicer for repayment instructions. You can find your loan servicer by logging into your account at:

🔗 StudentAid.gov (formerly StudentLoans.gov)

For more information about your rights and responsibilities as a borrower, visit:

🔗 Federal Student Loan Information – StudentAid.gov

If you have questions or need assistance, please contact the Moorpark College Financial Aid Office.

FEDERAL DIRECT LOAN INFORMATION

Moorpark College participates in the William D. Ford Federal Direct Loan Program. The U.S. Department of Education is the lender for the William D. Ford Federal Direct Loan Program.

CURRENT DRAFT COHORT DEFAULT RATE: 0, PRIOR 2.8

Loans must be repaid with interest so it is important to understand your rights and responsibilities as a borrower.

Dependent Student

First Year

Base Annual Amount: $3,500

Additional Unsubsidized: $2,000

Total Annual: $5,500

Second Year

Base Annual Amount: $4,500

Additional Unsubsidized: $2,000

Total Annual: $6,500

Third Year *for example Junior standing accepted into Bachelors degree program

Base Annual Amount: $5,500

Additional Unsubsidized: $2,000

Total Annual: $7,500

Undergraduate Aggregate Loan Limit $31,000 (no more than $23,000 may be Subsidized)

Independent Student

First Year

Base Annual Amount: $3,500

Additional Unsubsidized: $6,000

Total Annual: $9,500

Second Year

Base Annual Amount: $4,500

Additional Unsubsidized: $5,000

Total Annual: $10,500

Third Year *for example Junior standing accepted into Bachelors degree program

Base Annual Amount: $5,500

Additional Unsubsidized: $7,000

Total Annual: $12,500

Undergraduate Aggregate Loan Limit $57,500 (no more than $23,000 may be Subsidized)

Annual Interest Rates

Annual Interest Rates are set each July 1st.

Processing Loans

Loans are processed once you have completed online loan entrance test, and Master Promissory Note, MPN at https://studentaid.gov/mpn/ . Once you've completed these steps expect an email from our office to confirm the amount you'd like to borrow or feel free to call us to discuss.

Maximum annual award for PLUS is the student's Cost of Attendance minus any resources the student has been awarded. Plus Eligibility is contingent on approved credit which is only valid for 90 days. Do not apply prior to July 1st. Interest is charged on Direct PLUS Loans during all periods, beginning on the date of your loan's first disbursement. There is an origination fee.

**Please notify FA office if you are applying for Plus Loan.**

Dependent students whose parents have applied for but were unable to get a PLUS Loan may be eligible to receive additional Direct Unsubsidized Loan funds.

Students must provide a copy of the PLUS credit denial to the Financial Aid Office.

Right to Cancel: Before your loan money is disbursed, you may cancel all or part of your loan by notifying your school. After your loan money is disbursed, the student may notify the school in writing that they want to cancel all or part of the loan within 14 days after the date the school notifies you of your right to cancel all or part of the loan, or by the first day of your school’s payment period, whichever is later (your school can tell you the first day of the payment period). If you ask your school to cancel all or part of your loan outside the timeframes described above, your school may process your cancellation request, but it is not required to do so. Within 120 days of the date your school disbursed your loan money (by crediting the loan money to your account at the school, by paying it directly to you, or both), you may return all or part of your loan. Contact your servicer for guidance on how and where to return your loan money.

Loan Exit Counseling

Federal regulations require that all student borrowers who graduate, withdraw, or drop below half time enrollment complete Loan Exit Counseling. Always notify your servicer of your current address, phone number and contact information in a timely manner. The National Student Loan Data System (NSLDS) website has the most current contact information for the Holder/Servicer of your loan(s).

If you have federal student loans, you may be overwhelmed and confused by the barrage of announcements and information coming your way.

If you need individualized advice about student loans, please contact your loan servicer or reach out to one of the other resources listed below.

If you are a current student, you can learn more about terms and conditions for federal student loans issued for the 2025-2026 school year HERE.

I am worried about recent news regarding changes to my loan repayment options. What's happening?

In July 2025, President Trump signed into law a massive legislative package that makes major changes to federal higher education policy. The law restructures the federal student loan repayment system. In the coming months, the Education Department will undertake a regulatory process to more clearly define how these changes will be implemented.

The law divides borrowers into two categories based on when they took out their loans. Borrowers with loans taken out before July 1st, 2026, will retain access to some existing plans but lose access to others. Borrowers who take out loans after July 1st, 2026 will have fewer options.

Read more on these changes HERE.

Where can I figure out my repayment plan options and apply for a plan?

You can compare current plan options and apply for a plan HERE. You will need to log in to your StudentAid.gov account with your username and password to submit the application.

I’m worried about recent news about the Public Service Loan Forgiveness Program. What’s happening?

In June/July 2025, the Education Department held a rulemaking session to consider new regulations that would restrict which employers qualify for the PSLF program. The proposed changes stem from President Trump’s Executive Order 14235, which aims to bar borrowers from receiving PSLF if they work for employers, including government agencies and nonprofits, that the Education Secretary deems involved in “substantially illegal activities.” This is a hotly contested regulation that experts fear could include activities that are not technically illegal but that are counter to administration priorities.

The Education Department is expected to release draft rules for public comment soon. Final rules are expected to take effect in July 2026, but this timing could change. We will update this page as we know more.

I can’t afford my loan payments. What are my options?

You have the following options to lower or pause your payments:

- First, check which repayment plan you’re in by logging in to your StudentAid.gov account HERE. Then, compare your plan options using the Federal Student Aid Loan Simulator. If you’d like to switch into a different plan such an income-based plan, you can apply HERE.

- If you’re already in an income-based plan and your income has changed, you can update your income information to have your monthly payment re-calculated HERE.

If your monthly payments would still be unaffordable, you can temporarily pause your payments using deferment or forbearance. A deferment or forbearance allows you to temporarily stop making your federal student loan payments or temporarily reduce your monthly payment amount. Terms vary across options. Apply for a deferment or forbearance HERE.

I’ve tried getting help from my loan servicer but I still have unresolved issues. Where do I go from here?

- Submit a request to the Federal Student Aid Office of the Ombudsman. This is a neutral, informal, and confidential resource at the U.S. Department of Education to help resolve complaints about federal student loans. Get started HERE.

- Contact The Institute of Student Loan Advisors, which provides free student loan advice from trusted experts.

- Follow the National Consumer Law Center Student Loan Borrower Assistance Project, which provides free expert resources and can connect borrowers with legal assistance.

- Some states offer direct assistance through state student loan ombudsman offices. Find out if your state has an ombudsman HERE.

I don't know who my loan servicer is. How do i find out?

Log in to your StudentAid.gov account HERE, then visit your account dashboard and scroll down to the "My loan Servicers" section.

I think I may be eligible for loan forgiveness. How do I find out?

You can review current loan forgiveness options HERE to see if you qualify to have some or all of your balance forgiven.

I’m enrolled in the SAVE Plan. Where can I find updates on my loan status?

The U.S. Department of Education’s Office of Federal Student Aid provides official updates on the SAVE Plan HERE. This page is the most comprehensive official resource for announcements and information related to the SAVE Plan.

I’m working toward loan forgiveness in an income-based repayment plan. Where can I find updates on my payment progress?

The Education Department took down its payment tracking tool in April 2025. Education Secretary Linda McMahon said in June 2025 that it would be back up “soon” but has given no further details. We will update this page as we know more.

I’m enrolled in the Income-Based Repayment (IBR) Plan and think I’ve made enough payments to be eligible for loan forgiveness. Why am I still receiving bills?

According to the Education Department: “Currently, IBR forgiveness is paused while our systems are updated to accurately count months not affected by the court’s injunction [related to the SAVE Plan]. IBR forgiveness will resume once those updates are completed.” We will update this page as we know more.

I’m applying for Public Service Loan Forgiveness (PSLF). Where can I find updates on my loan status?

You can check the status of your PSLF application by logging in to StudentAid.gov with your account username and password, and selecting “View All Activity” from your account Dashboard.

Visit the Federal Student Aid Help Center for more details and resources.

Welcome Veterans

Thank You for your service!

In addition to the Veteran Educational Benefit programs, the Federal Student Aid programs such as the Federal Pell Grant or low-interest student loans are also available. Veterans benefits are not used to determine need so all veterans are encouraged to apply for the variety of Moorpark College federal and state financial aid programs. It’s free to complete the Free Application for Federal Student Aid (FAFSA) at www.fafsa.ed.gov

If you are a current or former veteran

And would like more information about Financial Aid at Moorpark College, please contact: Mona Luna, Financial Aid Specialist

Office: 805-378-1462

Who Can Qualify?

If you are a spouse, child or registered domestic partner of a veteran

You may qualify for fee waiver benefits. If you meet the criteria listed below, complete the California Department of Veterans Affairs college fee waiver program for veterans dependents application at: www.calvet.ca.gov

• Served during the "qualifying war period" and

• Has a service-connected disability, or

• Died while on active duty or as a result of a service-related condition

* Please note dependents of a member of the California National Guard who was killed or permanently disabled while in service to the state may be eligible for similar benefits.

GI Bill Eligibility/Benefits

Active Military Service & Education Loan Deferments

The borrower of an education loan, may be eligible to postpone repayment of that loan for up to three ( 3 ) years if serving on active duty during—

• A war or other military operation,

• A national emergency, or

• If performing qualifying National Guard duty under the same circumstances.

Note: For PLUS Loans, only principal is deferred – interest continues to accrue.

To see if your service qualifies you for a deferment of your loan payments, contact—

• Your lender and/or your loan servicing agency and request a military deferment or forbearance

• The United States Department of Veterans Affairs

For additional information, visit the following Web sites:

The United States Department of Veterans Affairs

The California Department of Veterans Affairs

*** Important information for U.S. Armed forces student loan borrowers ***

Transitioning into college life

is not always easy. We are here to support you.

Here are some additional agencies to help you with the transition process.

FINANCIAL AID RESOURCES

Anaisa Alonzo

Alphabetical caseload last names begins with letters: Q, R, S, T.

Financial Aid Specialist, and dual enrollment liaison.

Make an appointment or call (805) 553-4701 or email: aalonzo@vcccd.edu

Rosleen Aurora

Alphabetical caseload last name begins with letters: U, V, W, X, Y, Z.

Assistant Financial Aid Officer, homeless youth liaison, Multilingual speaking assistance in Hindi, Punjabi, and Urdu.

Make an appointment or call (805) 553-4691 or email: raurora@vcccd.edu

Camille Dunavin

Financial Aid Technician, make an appointment or call (805) 378-1462 or email: camille_dunavin1@vcccd.edu

Ramona Luna

Alphabetical caseload last names begins with letters: A, B, C.

Financial Aid Specialist, Veterans and EATM student liaison.

Make an appointment or call (805) 553-4704 or email: rluna@vcccd.edu

Vanessa Roberts

Alphabetical caseload last name begins with letters: H, I, J, K, L.

Financial Aid Specialist, ACCESS and Stem Impacto liaison.

Make an appointment or call (805) 553-4706 or email: vroberts@vcccd.edu

Claudia Solorzano

Alphabetical caseload last name beginning with letters: M, N, O, P.

Financial Aid Specialist, Dreamer liaison, bilingual speaking assistance in Spanish.

Make an appointment or call (805) 378-1466 or email: claudia_solorzano1@vcccd.edu

Rowella Stofka

Financial Aid Data Specialist, call (805) 553-4708 or email: rstofka@vcccd.edu

Alicia Trejo

Alphabetical caseload last name begins with letters: D, E, F, G.

Financial Aid Specialist, Athletes last name letters A-Z, Honors and PACE liaison.

Make an appointment or call (805) 553-4710 or email: alicia_trejo1@vcccd.edu

Student Loan Payments

Moorpark College is committed to keeping you updated with changes to the student loan program.

Additional Help with Student Loan Repayment

Moorpark College has partnered with Student Connections to make sure every borrower who is eligible for loan forgiveness receives it, and help any borrower with a remaining balance to navigate and prepare for payments. This service is completely free to you.

Student Connections Borrower Advocates can help answer any questions you have and determine what steps you need to take.

While you are in student loan repayment, Student Connections may contact you through emails, text messages and phone calls to:

- Help you understand your loan obligations and responsibilities.

- Discuss available options for an affordable repayment plan.

- Ensure you are aware of repayment options during financial hardships.

- Promote your long-term repayment success.

These advocates are available to answer questions about your outstanding loans and, when appropriate, work with you and your loan servicer. Visit www.repaymyloans.org or talk to a borrower advocate for free at (866) 311-9450.

Who is Student Connections?

Student Connections is passionate about helping students. They partner with schools to provide support for borrowers throughout the student loan repayment process. With more than 60 years of experience in counseling student loan borrowers, their primary goal is to help establish the best repayment plan for you.

FAFSA

Application for the Free Application for Federal Student Aid

(Free Application for Federal Student Aid) PH: 800-433-3243

California College Promise Grant

PH: 800-468-6927

CSAC (California Student Aid Commission)

Learn more about state financial aid and the Cal Grant Program! PH: 888-224-7268

and 916-526-7590

BankMobile Disbursements

Refund options for receiving Financial Aid Disbursements PH: 877-405-5434

Studentaid.gov

Entrance Counseling and Master Promissory Note

NSLDS

The US Department of Education’s NSLDS website allows students to check on their financial aid status. PH: 800-999-8219

FastWeb

The largest FREE scholarship database in the nation.

IRS.gov

Order IRS tax transcript for Financial Aid purposes. PH: 800-829-1040

www.ss.gov

Local Social Security Office: 322 E. Thousand Oaks Blvd suite 110, Thousand Oaks, Ca. 91360

www.sss.gov

Online registration for selective services

FAFSA/CalFresh/Dream Act Workshops

Financial Aid Workshops:Cash for College

FAFSA/CalFresh/Dream Act WORKSHOP HOURS online by appointment

TO APPLY FOR CALFRESH

STUDENTS' MUST MEET ONE OF THE REQUIREMENTS

- Working and getting paid for an average of 20 hours per week OR a total of 80 hours a month on average.

- Approved (or awarded or accepted) for federal or state work study, anticipates working, and has not refused a work assignment (can still be eligible even if a work study job has not begun or is not currently available).

- Students attending CSU or UC, receiving Cal Grant A OR B, and falling within the following qualifications : un-married; AND 25 years of age or younger; AND household income less than $50,000.

- Enrolled in a state funded program that increases employability (EOP, EOPS, WIOA, DSPS, CARE, UC McNair, Puente Project, or MESA)***

- Enrolled in a program that increases employability for current and former foster youth (Guardian Scholars, FYSI, CAFYES, ETV or Extended Foster Care)***

- Exerting parental control over a dependent household member under the age of 6 OR between the age of 6 and 12 with no adequate childcare (as determined by the county on a case-by-case basis).

- Single parent of a dependent household member under the age of 12 and enrolled in at least 6 units

- Participating in the CalFresh Employment and Training Program (CFET) or Job Opportunities and Basic Skills (JOBS), or be a recipient of CalWORKs or Aid to Families with Dependent Children (AFDC).

The FAFSA and CalFresh (Free Application Federal Student Aid) workshop is designed to assist Moorpark College Students in filling out and submitting their FAFSA and CalFresh Application.

It is recommended you obtain an FSA ID prior to attending a workshop.

The Free Application for Financial Aid (FAFSA) is an online application that will help you be considered for some financial aid programs. You must complete this application every award year.

Apply for an Enrollment Fee Waiver

The California College Promise Grant program determines if you qualify to have your enrollment fees waived. This fee waiver is for California residents only. *Note if you have completed a FAFSA you have already applied and don’t need to do a separate application for Enrollment Fee Waiver.

Apply for State Financial Aid through a Dream Act Application

This application is used to determine the eligibility of AB 540 [undocumented] students for California student financial aid for the school year. The California Student Aid Commission will process this application. Any aid offered can only be used at eligible California institutions. The information on this form will be used by the California Student Aid Commission to determine eligibility in the state Cal Grant program and Promise formerly known as BOG Fee waiver.

Cal Grant GPA Verification Form

To be considered for a Cal Grant award, you must have completed both of these application requirements by the March 2, or September 2, deadline:

- Submitted a Free Application for Federal Student Aid (FAFSA) or a California Dream Act Application.

- Ensured that a certified Grade Point Average (GPA) was submitted to the California Student Aid Commission (Commission).

The Commission will not process any GPAs that may have been submitted in prior years. In order for a student to be considered for a Cal Grant award, a new GPA form must be received by the Commission by the stated deadline.

The California Chafee Grant Program gives free money to current or former foster youth to use for vocational school training or college courses. To qualify, you must be a current or former foster youth, must have established court dependency at any time between the ages of 16 and 18, and must not have reached your 22nd birthday as of July 1st of the award year.

Additional forms may be necessary to complete your financial aid application. Please only submit requested forms. If we request additional forms, they will appear in your student portal.

Improve your Financial Wellness

As you embark on your college journey, it’s important to understand how money really ‘works.’ Now is a great time to learn about making money, managing money, saving money – and how to make informed decisions about money. CashCourse is your real-life guide to taking charge of your money. It provides you with the online personal finance tools to help you build real-life-ready financial skills. In addition, you can learn about financial aid basics and research scholarships.

Moorpark College Online Orientation

Moorpark College is committed to helping you achieve your academic success. We have developed our orientation program to provide you with an introduction and the necessary tools to get you started. This orientation is considered a student’s first counseling contact. Please allow at least one hour to effectively complete this orientation.

As students and their families make important decisions about investing their time and money in pursuing a college education, the California Community Colleges Chancellor’s Office is making available for the first time comparative information about the earnings of recent graduates who received an award in a specific program area at California community colleges.

The Salary Surfer uses the aggregated earnings of graduates from a five year period to provide an estimate on the potential wages to be earned two years and five years after receiving a certificate or degree in certain disciplines. This tool also provides information on which colleges offer programs in those specific disciplines. The Salary Surfer does not contain information about wages earned by community college students who transfer to a four-year institution.

While it is useful to know the potential earnings after receiving a certificate or degree, other important considerations, such as personal interest and skill, should be used in selecting an educational program.

Financial Wellness Cash Course

Your Real-Life Money Guide

When you’re a student, it can feel like money is always tight. You’ve got bills, rent, and tuition to pay, and you want to have enough money for fun, too. So how can you get on the right path to a great financial future, while making your money count today?

CashCourse real-life guide: Take charge of YOUR money

Our online personal finance tools help you build real-life-ready financial skills. Please visit Cash Course to find out more about getting your finances in order and learn about financial aid basics and options.

Step 1: Sign in to your my.vcccd portal

Step 2: Go to the "Registration" Tab on the left side of the screen

Step 3: Select "Register/Add/Drop"

Step 4: Go to "Registration Planner"

Step 5: Select "Edit/Drop Class"

Step 6: Select "Registration Status" for the class you'd like to drop

Step 7: Select "Drop with Refund" from the drop down menu *refunds occur if student drops by the refund deadline date

Step 8: Select "save" to drop the course

GENERAL INFO

Frequently Asked Questions

Is it required for FAFSA applicants to complete the gender question?

Yes, completion of the gender question is required for FAFSA submission. Responses to this question will not impact eligibility for aid and will not be shared with institutions.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

- 2025-26 FSA Handbook

Is a student able to skip the question on the online application?

No, students cannot skip the gender question on the online FAFSA application. The system requires a response of either "male" or "female" to process the application.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

- NASFAA News, How ED’s Revised Options for Gender on the FAFSA Will Impact the Correction Process

If the question is skipped on either the online application or paper form, can this result in an error and/or flag for verification?

On the online application, the system requires a response to the gender question; thus, skipping it is not possible. For paper FAFSA forms submitted after February 14, 2025, the February 18, 2025 guidance indicates that processing will still occur, "regardless of the answer indicated, and will not require a correction. Institutions do not need to take any action." It is unclear if this is inclusive of instances of skipped entry of Question 11. We recommend for students to answer all questions to the best of their ability to avoid a potential processing error.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

If a student changes their gender selection from one year to the next, can this trigger verification?

The gender/sex question is used for statistical and research purposes by the Department of Education and does not affect aid eligibility. Therefore, discrepancies in gender responses across time would not be a factor for aid distribution or calculation and would not be rationale for verification.

For each award year, the Secretary of Education publishes in the Federal Register a list of the FAFSA information that an institution or applicant may be required to verify. The 2025-26 variant, published, September 9, 2024, does not indicate gender or sex.

- NASFAA News, How ED’s Revised Options for Gender on the FAFSA Will Impact the Correction Process

- FSA Handbook 2025-2026 Application and Verification Guide

- Federal Register, Free Application for Federal Student Aid (FAFSA) Information To Be Verified for the 2025-2026 Award Year

Students and parents are required to create an FSA ID to complete the FAFSA. Does FSA ID require an individual to indicate their gender? And if so, is it required for the FSA ID and FAFSA gender selections to match?

The FSA ID creation process does not have a field for gender or sex. Consequently, there is no requirement for the gender selections on the FSA ID and FAFSA to match.

- FSA Handbook 2025-2026 Application and Verification Guide

- FSA Video Guide, How to Create an Account Username (FSA ID) for StudentAid.gov

- FSA Creating and Using the FSA ID

Are students required to use their legal name for completing a FAFSA?

Yes, students must use their legal name as registered with the Social Security Administration (SSA) when completing the FAFSA. This would be the equivalent as read on the students' social security card. This ensures that the student's information matches SSA records; if there is not a match, this may cause delays and /or the need to correct the input with the SSA.

What if a student already submitted a 2024-25 or 2025-26 FAFSA form before February 14, 2025 indicating "non-binary" or "prefer not to answer" for Question 11?

No action is required by the student or institution, regardless of response to Question 11.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

What if a Student initiates a correction on the 2024-25 or 2025-26 FAFSA form before February 14, 2025?

- If a student attempts to submit a correction for any item on their 2024-25 or 2025-26 form and they previously indicated "Non-binary" or "Prefer not to answer," they will be required to also answer and update Question 11 to resubmit the FAFSA form.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

What if an INSTITUTION initiates a correction (e.g. verification, professional judgement, etc) to the 2024-25 or 2025-26 FAFSA form from before February 14, 2025?

"Corrections that are initiated by the institutions, regardless of method (FAFSA Partner Portal or EDE), will not require an updated response value to be entered, regardless of the student's previous answer to Question 11."

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

While the FAFSA form includes responses to the student's gender, race, and ethnicity, these fields are not accessible by the institution nor included in the ISIR. "They are not included in the FAFSA Partner Portal or correctable by the FAA. These fields are included on the FAFSA Submission Summary and are only correctable by the student."

Can I use my financial aid to purchase a computer/laptop?

Yes. Your financial aid can be used to purchase a computer to help you with your educational needs. Did you know you can borrow a laptop thru the lending program administered through the library?

I do not have a laptop for online courses, what can I do? or I need a hotspot?

Moorpark College has a laptop lending program administered through the library. Yes, completion of the gender question is required for FAFSA submission. Responses to this question will not impact eligibility for aid and will not be shared with institutions.

I just completed my financial aid requirements; will I receive financial aid?

It is extremely important that once all requirements are completed, you monitor your portal weekly for updates on your status.

If eligible, an award notification email will be sent to your my.vcccd.edu account once the file review process is complete.

Is it too late to apply for financial aid?

No. We strongly encourage you to apply today! Please visit our website for more information on how to apply.

What happens if I am unable to continue attending school?

We strongly recommend you talk with your instructor(s) before you withdraw from your class(es). We also ask you contact the Financial Aid Office so we can discuss how this will affect your current and/or future financial aid eligibility. Lastly, we recommend you speak to your academic counselor and the Admissions and Records Office to discuss any other alternatives that may be available.

Will I have to repay my financial aid if I stop attending, completely withdraw or fail all of my classes this semester?

If you stop attending, completely withdraw or fail all of your courses you may not be eligible for the full amount of financial aid funds that you were originally scheduled to receive. The Financial Aid Office will determine the amount of aid you have “earned” and/or the amount you may owe. See Return of Title IV Funds (R2T4) for more information.

- How do I apply for financial aid?

- Who's my parent?

- What is a California College Promise Grant ?

- What are grants?

- What are financial need, Cost of Attendance (COA), and Expected Family Contribution?

- How do I know if am a Dependent or Independent student?

- What is Work-Study?

- Did you know?

- How do I communicate with the Moorpark College Financial Aid Office?

We recommend you regularly check your MyVCCCD student portal for updates or changes to your financial aid.

We offer programs and services to help meet some of your educational costs. Financial aid applications are accepted throughout the academic year but we encourage you to apply as soon as possible.

The Financial Aid Office is comprised of dedicated financial aid professionals committed to serving students and provide them information to secure the necessary financial resources to meet their educational objectives. Financial aid awards are subject to availability of funds, eligibility for funds, enrollment status and financial need.

- Provide student centered service, information, and identify financing options to students seeking financial assistance

- Maintain efforts to minimize the student loan default rate

- Identify, outreach to, and increase both financial aid participation and student access to locally defined un-served, under-served, and DI student populations

- Increase awareness on campus and at local high schools of financial aid

Students learning outcomes:

- Students who attend an application assistance session will learn how to complete & submit applications, and meet deadlines.

- Students who complete online SAP counseling session will demonstrate knowledge and understanding of the Satisfactory Academic Progress "SAP" standards for maintaining financial aid eligibility and apply that knowledge to their academic situation and/or circumstances.

- Students who take out a loan will gain understanding of the requirements, rights and responsibilities, and repayment obligations associated with acquiring a federal student loan.

Moorpark College Mission

Grounded in equity, social justice, and a students first philosophy, Moorpark College values diverse communities. We empower learners from local, national, and global backgrounds to complete their degree, certificate, transfer, and career education goals. Through innovation and customized student support, our programs are designed to achieve equitable outcomes