Live Assistance Via Zoom

Click here for Live Assistance during the hours below

Monday: 11:00am-12:00pm & 1:00pm-3:00pm

Tuesday: 11:00am-12:00pm, 1:00pm-3:00pm, & 4:00pm-6:00pm

Wednesday: 11:00am-12:00pm & 1:00pm-3:00pm

Thursday: 11:00am-12:00pm & 1:00pm-3:00pm

Friday: Closed

Most students (and parents) complete the application with assistance in less than 30 minutes. Our goal is to help you finish the application in just one session! We take you step-by-step on how to get the money you need for tuition, textbooks and living expenses.

Fire Assistance Now Available to Students

Funds are available for Moorpark College students who have been directly affected by the recent fires – loss of home or residence, car, personal belongs. To access funding use this PDF form to apply through financial aid (this will not affect current financial aid). The Foundation will review the form and reach out to you.

“My parents make too much money, so I won’t qualify for aid.”

Reality

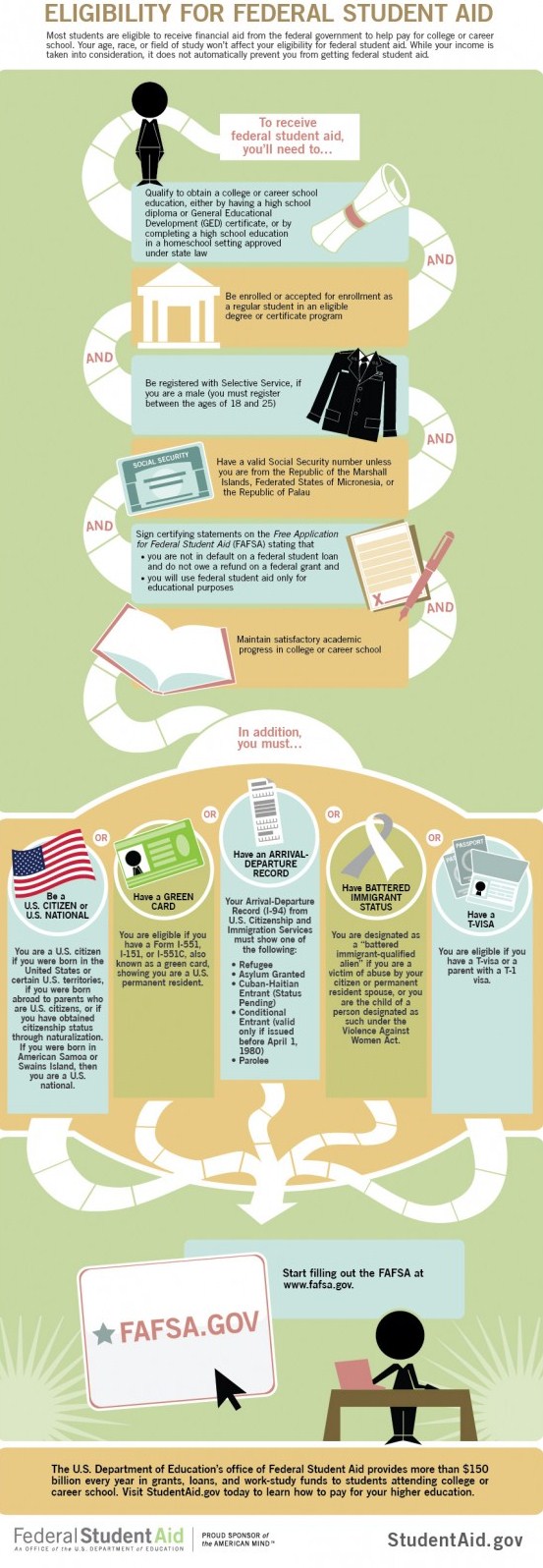

There is no income cut-off to qualify for federal student aid. Many factors—such as the size of your family and your year in school—are taken into account. Remember: when you fill out the Free Application for Federal Student Aid (FAFSA® ) form, you’re also automatically applying for funds from your state and possibly from your school as well. In fact, some schools won’t even consider you for any of their scholarships (including academic scholarships) until you’ve submitted a FAFSA form. Don’t make assumptions about what you’ll get—fill out the FAFSA form and find out.

WebGrants 4 Students Creating an Account

Tuition Free College

Moorpark College Promise is available to all High School grads and is a tuition free opportunity regardless of income status. If you need help paying your enrollment fees and haven't done FAFSA or California Dream Act Application(CADAA) apply for the California College Promise Grant (CCPG) available to California residents.

Moorpark College Federal School Code is 007115

Is there still time to add a session? Lisa Gallardo with CCC Rising Scholars project would like to present.

Is it too late to apply for financial aid?

No! We strongly encourage you to apply today! If you need help, we're available virtually and in person to assist.

Additional Aid

Federal School Code: 007115

Additional financial aid is available to eligible students. Fill out the FAFSA for any additional assistance. Many students find out that they have more financial assistance when they fill out the FAFSA on time!

Students may receive federal financial aid from only one school during any given semester; however, if you attend a 4 year university and a community college you may be eligible to receive a fee waiver at the community college.

PAY FOR COLLEGE

We want to inform you of important changes regarding the payment of fees for the Spring 2025 semester. As of this semester, we will reinstate the Drop for Nonpayment policy. Please read the following details carefully to ensure you remain enrolled in your courses.

Key Changes

1. Payment Requirement:

Students must pay their enrollment fees to avoid being dropped for nonpayment. To maintain your enrollment, you can:

-

Pay your fees in full upon registration.

-

Set up a payment plan via the MyVCCCD student portal or contact the Student Business Office.

-

Ensure any financial aid or exemptions are active.

2. Unpaid Balances:

-

If you have an unpaid balance from previous semesters, it must be settled before you can register for Spring 2025. A hold will be placed on your account until the balance is paid in full.

3. Drop Process Timeline:

-

The drop process for unpaid Spring 2025 fees begins on December 17, 2024.

-

From October 28, 2024 to December 16, 2024, the process will be in Audit Mode; you will receive reminders but will not be dropped.

-

From December 17, the process will switch to Update Mode, and students who have not paid will be dropped from their classes.

4. Payment Grace Period:

-

If you register after December 17, 2024, you will have up to 7 days to pay your fees. This period decreases as the class start date approaches (1 day payment required once classes begin).

5. Exemptions:

-

Certain students are exempt from the drop process, including those with active payment plans, dual enrollment students, financial aid recipients, and verified military connected students using GI Bill® benefits.

Important Actions to Avoid Being Dropped:

-

Pay your fees in full upon registration.

-

Set up a payment plan through the MyVCCCD portal.

-

Ensure all financial aid and exemptions are in place and active.

Additional Information:

-

To check your balance or set up a payment plan, log into your MyVCCCD student portal or contact the Student Business Office.

-

The Spring 25 payment plan option will be available starting October 28, 2024.

-

Please visit the Paying for College Web page for more information.

Notifications:

You will receive email alerts and MyVCCCD notifications regarding any unpaid balances and due dates. Please stay informed to avoid being dropped from your courses.

For more details and assistance, feel free to contact the Student Business Office.

The Board of Governors of the California Community College system offers a fee waiver program for low-income residents of California that are attending a community college. The California College Promise Grant (CCPG) will waive all per-unit enrollment fees ($46 per unit) for an eligible student. If you need money to help with books, supplies, transportation and other costs, please complete a Free Application for Federal Student Aid (FAFSA) or the California Dream Application (for eligible AB 540 students). It's OK to file both a CCPG and a FAFSA. We will let you know if you qualify for an automatic FEE WAIVER. If you do NOT qualify using the simple online application method, you should file a FAFSA. Many, many students do not qualify under Methods A or B, but still qualify for a Method C fee waiver and additional financial aid by filing the FAFSA.

Apply now for a California College Promise Grant

To qualify for the California College Promise Grant [CCPG] Program, you must:

Be classified as a resident of California or be a non-California resident eligible for tuition exemption AB 540, or AB 1899 student by Admissions and Records, and for California resident homeless youth as determined by the Financial Aid Office.

If you have not had your California residency or eligibility status determined by the Admissions or the Registrar or homeless status determined by the Financial Aid Office, see one of those offices to obtain the determination. California College Promise Grant eligibility cannot be determined until your status has been verified.

Meet income criteria by:

- o Providing proof that you are receiving monthly cash assistance from TANF/CalWORKs, SSI/SSP or General Assistance (or, if a dependent student, your parent(s) receive this assistance) or

- o Establishing that your income (or your parent's income, if you are a dependent student) was within set income standards for the CCPG or

- o Completing a FAFSA (Free Application for Federal Student Aid) and have remaining financial need or

- o Being a Congressional Medal of Honor recipient (or dependent); being a dependent of a victim of the Sept. 11, 2001, terrorist attack; having certification from the California Department of Veteran Affairs or the National Guard Adjutant General; or being a dependent of a deceased law enforcement/fire suppression personnel killed in the line of duty that you are eligible for this waiver.

- Having documentation from the Department of Corrections and Rehabilitation that you've been exonerated of a crime by writ of habeas corpus or pardon.

- Having documentation of record that you're a dependent/spouse/Registered Domestic Partner of a deceased physician, nurse, or first responder who died of COVID-19 during the COVID-19 pandemic state of emergency in California.

California College Promise Grant Program Part B

These standards are based upon the federal poverty guidelines as published each year by the US Department of Health and Human Services. Under Title 5 of the California code of Regulations, the income standards for the program equal 150% of the federal poverty guidelines for the base year.

These standards are to be used to determine Fee Waiver B eligibility.

What is the Moorpark College Promise?

- First two years free at Moorpark College!

- You can qualify, even if you're not eligible for federal financial aid!

How do I receive the Moorpark College Promise?

- Apply to Moorpark College

- Must be first year/first time student

- Submit a FAFSA or Dream Act application each year

- Add Moorpark College to your FAFSA or CADAA school code 007115

- Must be a California Resident or AB 540 Student

- Enroll full time (12+ units)

How do I receive the Moorpark College Promise in my second year?

- Complete FAFSA or Dream Act applications each year

- Add Moorpark College to your FAFSA or CADAA school code 007115

- Enroll full time (12+ units)

- Must be a California resident or AB 540 student

How do I register for classes?

- Check your VCCCD portal for registration appointment or contact Admissions and Records

Award Notifications

- Moorpark College Promise awards will be posted on your student portal after you have obtained full time enrollment and provided a financial aid application. You will receive an email notification to your my.vcccd.edu email account. You may inquire to the financial aid office if you do not see the award about your eligibility. Awards for future terms may not occur until close to term start and dependent on funding from state legislation

- Monitor your VCCCD portal weekly to be aware of any changes in your status

APPLICATION SEARCH

One application can lead to many scholarship opportunities.

To ensure your application receives full consideration, complete the application by answering as many questions as possible. The more information you provide, the more opportunities you have to be matched to various scholarships. Scholarship matches are based on the answers you provide on the questionnaire. Also, on the essay that will require a personal statement, information on community service, leadership, work experience, and financial need. You will need to provide an unofficial transcript, a letter of recommendation from a faculty member, counselor, administrator, employer, or co-worker. Scholarship Webpage

How do I receive a Direct Loan at Moorpark College?

- Complete a Free Application for Federal Student Aid (FAFSA) online at www.FAFSA.gov for the school year you intend to enroll.

- Complete and/or submit all requested financial aid requirements as listed on your my.vcccd.edu portal.

- Receive an award notification email indicating that your financial aid file review is complete.

- Continue to meet the minimum Satisfactory Academic Progress (SAP) standards to ensure eligibility.

- Enroll in 6 or more degree-applicable units for an eligible Moorpark College program of study during the desired loan application period.

- Complete Direct Loan Entrance Counseling online at studentaid.gov/entrance-counseling.

- Complete a Direct Loan Promissory Note online at studentaid.gov/mpn.

Are there any other eligibility requirements?

Eligibility is not guaranteed. Applicants must meet all federal aid eligibility requirements. MC reserves the right to refuse to certify a loan under conditions established by 34.CFR 685.301. Borrowing the low-interest, Federal Direct Loan is a privilege. Some conditions for refusing to certify a loan to high risk borrowers include but are not limited to:

- The student is not making progress or enrolled in an eligible degree, certificate or transfer program at Moorpark College. This decision is made independently from the (SAP) Appeal process.

- The student has already borrowed the maximum loan amount appropriate for community college programs.

- The student appears to be or has been in default or delinquent on federal financial aid obligations.

- Notification of previously discharged federal student loans due to disability or bankruptcy.

- Instances of inconsistent, fraudulent FAFSA, or admissions application information.

- The student has a drastic change in requested borrowing amount from previous year(s).

- The student has valid and applicable education for employment and is choosing to pursue another educational endeavor. This decision is made independently from the SAP Appeal process.

FEDERAL DIRECT LOAN INFORMATION

Moorpark College participates in the William D. Ford Federal Direct Loan Program. The U.S. Department of Education is the lender for the William D. Ford Federal Direct Loan Program.

CURRENT DRAFT COHORT DEFAULT RATE: 0, PRIOR 2.8

Loans must be repaid with interest so it is important to understand your rights and responsibilities as a borrower.

Dependent Student

First Year

Base Annual Amount: $3,500

Additional Unsubsidized: $2,000

Total Annual: $5,500

Second Year

Base Annual Amount: $4,500

Additional Unsubsidized: $2,000

Total Annual: $6,500

Third Year *for example Junior standing accepted into Bachelors degree program

Base Annual Amount: $5,500

Additional Unsubsidized: $2,000

Total Annual: $7,500

Undergraduate Aggregate Loan Limit $31,000 (no more than $23,000 may be Subsidized)

Independent Student

First Year

Base Annual Amount: $3,500

Additional Unsubsidized: $6,000

Total Annual: $9,500

Second Year

Base Annual Amount: $4,500

Additional Unsubsidized: $5,000

Total Annual: $10,500

Third Year *for example Junior standing accepted into Bachelors degree program

Base Annual Amount: $5,500

Additional Unsubsidized: $7,000

Total Annual: $12,500

Undergraduate Aggregate Loan Limit $57,500 (no more than $23,000 may be Subsidized)

Annual Interest Rates

Annual Interest Rates are set each July 1st.

Processing Loans

Loans are processed once you have completed online loan entrance test, and Master Promissory Note, MPN at https://studentaid.gov/mpn/ . Once you've completed these steps expect an email from our office to confirm the amount you'd like to borrow or feel free to call us to discuss.

Maximum annual award for PLUS is the student's Cost of Attendance minus any resources the student has been awarded. Plus Eligibility is contingent on approved credit which is only valid for 90 days. Do not apply prior to July 1st. Interest is charged on Direct PLUS Loans during all periods, beginning on the date of your loan's first disbursement. There is an origination fee.

**Please notify FA office if you are applying for Plus Loan.**

Dependent students whose parents have applied for but were unable to get a PLUS Loan may be eligible to receive additional Direct Unsubsidized Loan funds.

Students must provide a copy of the PLUS credit denial to the Financial Aid Office.

Right to Cancel: Before your loan money is disbursed, you may cancel all or part of your loan by notifying your school. After your loan money is disbursed, the student may notify the school in writing that they want to cancel all or part of the loan within 14 days after the date the school notifies you of your right to cancel all or part of the loan, or by the first day of your school’s payment period, whichever is later (your school can tell you the first day of the payment period). If you ask your school to cancel all or part of your loan outside the timeframes described above, your school may process your cancellation request, but it is not required to do so. Within 120 days of the date your school disbursed your loan money (by crediting the loan money to your account at the school, by paying it directly to you, or both), you may return all or part of your loan. Contact your servicer for guidance on how and where to return your loan money.

Loan Exit Counseling

Federal regulations require that all student borrowers who graduate, withdraw, or drop below half time enrollment complete Loan Exit Counseling. Always notify your servicer of your current address, phone number and contact information in a timely manner. The National Student Loan Data System (NSLDS) website has the most current contact information for the Holder/Servicer of your loan(s).

Welcome Veterans

Thank You for your service!

In addition to the Veteran Educational Benefit programs, the Federal Student Aid programs such as the Federal Pell Grant or low-interest student loans are also available. Veterans benefits are not used to determine need so all veterans are encouraged to apply for the variety of Moorpark College federal and state financial aid programs. It’s free to complete the Free Application for Federal Student Aid (FAFSA) at www.fafsa.ed.gov

If you are a current or former veteran

And would like more information about Financial Aid at Moorpark College, please contact: Mona Luna, Financial Aid Specialist

Office: 805-378-1462

Who Can Qualify?

If you are a spouse, child or registered domestic partner of a veteran

You may qualify for fee waiver benefits. If you meet the criteria listed below, complete the California Department of Veterans Affairs college fee waiver program for veterans dependents application at: www.calvet.ca.gov

• Served during the "qualifying war period" and

• Has a service-connected disability, or

• Died while on active duty or as a result of a service-related condition

* Please note dependents of a member of the California National Guard who was killed or permanently disabled while in service to the state may be eligible for similar benefits.

GI Bill Eligibility/Benefits

Active Military Service & Education Loan Deferments

The borrower of an education loan, may be eligible to postpone repayment of that loan for up to three ( 3 ) years if serving on active duty during—

• A war or other military operation,

• A national emergency, or

• If performing qualifying National Guard duty under the same circumstances.

Note: For PLUS Loans, only principal is deferred – interest continues to accrue.

To see if your service qualifies you for a deferment of your loan payments, contact—

• Your lender and/or your loan servicing agency and request a military deferment or forbearance

• The United States Department of Veterans Affairs

For additional information, visit the following Web sites:

The United States Department of Veterans Affairs

The California Department of Veterans Affairs

*** Important information for U.S. Armed forces student loan borrowers ***

Transitioning into college life

is not always easy. We are here to support you.

Here are some additional agencies to help you with the transition process.

FINANCIAL AID RESOURCES

Anaisa Alonzo

Alphabetical caseload last names begins with letters: Sb-Sz, T, U, V, W, X, Y, Z, A.

Financial Aid Specialist, Athletes last name letters L-Z and dual enrollment liaison.

Make an appointment or call (805) 553-4701 or email: aalonzo@vcccd.edu

Angelina Artero

Student Services Assistant, make an appointment or call (805) 378-1462 or email: angelina_artero1@vcccd.edu

Rosleen Aurora

Alphabetical caseload last name begins with letters: L, M, N.

Financial Aid Specialist, homeless youth liaison, Multilingual speaking assistance in Hindi, Punjabi, and Urdu.

Make an appointment or call (805) 553-4691 or email: raurora@vcccd.edu

Camille Dunavin

Student Services Assistant, make an appointment or call (805) 378-1462 or email: camille_dunavin1@vcccd.edu

Ramona Luna

Alphabetical caseload last names begins with letters: B, C, O, Q.

Financial Aid Specialist, Veterans and EATM student liaison.

Make an appointment or call (805) 553-4704 or email: rluna@vcccd.edu

Alejandro Mercado

Financial Aid Technician, bilingual speaking assistance in Spanish. Make an appointment or call (805) 553-4671 or email: amercado@vcccd.edu

Vanessa Roberts

Alphabetical caseload last name begins with letters: Gon-Gz, H, I, J, K.

Financial Aid Specialist, ACCESS and Stem Impacto liaison.

Make an appointment or call (805) 553-4706 or email: vroberts@vcccd.edu

Claudia Solorzano

Alphabetical caseload last name beginning with letters: P, R, S-Sa

Financial Aid Specialist, Dreamer liaison, bilingual speaking assistance in Spanish.

Make an appointment or call (805) 378-1466 or email: claudia_solorzano1@vcccd.edu

Rowella Stofka

Financial Aid Data Specialist, call (805) 553-4708 or email: rstofka@vcccd.edu

Alicia Trejo

Alphabetical caseload last name begins with letters: D, E, F, Ga-Gom.

Financial Aid Specialist, Athletes last name letters A-K, Honors and PACE liaison.

Make an appointment or call (805) 553-4710 or email: alicia_trejo1@vcccd.edu

Student Loan Payments

Moorpark College is committed to keeping you updated with changes to the student loan program.

Additional Help with Student Loan Repayment

Moorpark College has partnered with Student Connections to make sure every borrower who is eligible for loan forgiveness receives it, and help any borrower with a remaining balance to navigate and prepare for payments. This service is completely free to you.

Student Connections Borrower Advocates can help answer any questions you have and determine what steps you need to take.

While you are in student loan repayment, Student Connections may contact you through emails, text messages and phone calls to:

- Help you understand your loan obligations and responsibilities.

- Discuss available options for an affordable repayment plan.

- Ensure you are aware of repayment options during financial hardships.

- Promote your long-term repayment success.

These advocates are available to answer questions about your outstanding loans and, when appropriate, work with you and your loan servicer. Visit www.repaymyloans.org or talk to a borrower advocate for free at (866) 311-9450.

Who is Student Connections?

Student Connections is passionate about helping students. They partner with schools to provide support for borrowers throughout the student loan repayment process. With more than 60 years of experience in counseling student loan borrowers, their primary goal is to help establish the best repayment plan for you.

FAFSA

Application for the Free Application for Federal Student Aid

(Free Application for Federal Student Aid) PH: 800-433-3243

California College Promise Grant

PH: 800-468-6927

CSAC (California Student Aid Commission)

Learn more about state financial aid and the Cal Grant Program! PH: 888-224-7268

and 916-526-7590

BankMobile Disbursements

Refund options for receiving Financial Aid Disbursements PH: 877-405-5434

Studentaid.gov

Entrance Counseling and Master Promissory Note

NSLDS

The US Department of Education’s NSLDS website allows students to check on their financial aid status. PH: 800-999-8219

FastWeb

The largest FREE scholarship database in the nation.

IRS.gov

Order IRS tax transcript for Financial Aid purposes. PH: 800-829-1040

www.ss.gov

Local Social Security Office: 322 E. Thousand Oaks Blvd suite 110, Thousand Oaks, Ca. 91360

www.sss.gov

Online registration for selective services

FAFSA/CalFresh/Dream Act Workshops

Financial Aid Workshops:Cash for College

FAFSA/CalFresh/Dream Act WORKSHOP HOURS online by appointment

TO APPLY FOR CALFRESH

STUDENTS' MUST MEET ONE OF THE REQUIREMENTS

-

Working and getting paid for an average of 20 hours per week OR a total of 80 hours a month on average.

-

Approved (or awarded or accepted) for federal or state work study, anticipates working, and has not refused a work assignment (can still be eligible even if a work study job has not begun or is not currently available).

-

Students attending CSU or UC, receiving Cal Grant A OR B, and falling within the following qualifications : un-married; AND 25 years of age or younger; AND household income less than $50,000.

-

Enrolled in a state funded program that increases employability (EOP, EOPS, WIOA, DSPS, CARE, UC McNair, Puente Project, or MESA)***

-

Enrolled in a program that increases employability for current and former foster youth (Guardian Scholars, FYSI, CAFYES, ETV or Extended Foster Care)***

-

Exerting parental control over a dependent household member under the age of 6 OR between the age of 6 and 12 with no adequate childcare (as determined by the county on a case-by-case basis).

-

Single parent of a dependent household member under the age of 12 and enrolled in at least 6 units

-

Participating in the CalFresh Employment and Training Program (CFET) or Job Opportunities and Basic Skills (JOBS), or be a recipient of CalWORKs or Aid to Families with Dependent Children (AFDC).

The FAFSA and CalFresh (Free Application Federal Student Aid) workshop is designed to assist Moorpark College Students in filling out and submitting their FAFSA and CalFresh Application.

It is recommended you obtain an FSA ID prior to attending a workshop.

The Free Application for Financial Aid (FAFSA) is an online application that will help you be considered for some financial aid programs. You must complete this application every award year.

Apply for an Enrollment Fee Waiver

The California College Promise Grant program determines if you qualify to have your enrollment fees waived. This fee waiver is for California residents only. *Note if you have completed a FAFSA you have already applied and don’t need to do a separate application for Enrollment Fee Waiver.

Apply for State Financial Aid through a Dream Act Application

This application is used to determine the eligibility of AB 540 [undocumented] students for California student financial aid for the school year. The California Student Aid Commission will process this application. Any aid offered can only be used at eligible California institutions. The information on this form will be used by the California Student Aid Commission to determine eligibility in the state Cal Grant program and Promise formerly known as BOG Fee waiver.

Cal Grant GPA Verification Form

To be considered for a Cal Grant award, you must have completed both of these application requirements by the March 2, or September 2, deadline:

-

Submitted a Free Application for Federal Student Aid (FAFSA) or a California Dream Act Application.

-

Ensured that a certified Grade Point Average (GPA) was submitted to the California Student Aid Commission (Commission).

The Commission will not process any GPAs that may have been submitted in prior years. In order for a student to be considered for a Cal Grant award, a new GPA form must be received by the Commission by the stated deadline.

The California Chafee Grant Program gives free money to current or former foster youth to use for vocational school training or college courses. To qualify, you must be a current or former foster youth, must have established court dependency at any time between the ages of 16 and 18, and must not have reached your 22nd birthday as of July 1st of the award year.

Additional forms may be necessary to complete your financial aid application. Please only submit requested forms. If we request additional forms, they will appear in your student portal.

Improve your Financial Wellness

As you embark on your college journey, it’s important to understand how money really ‘works.’ Now is a great time to learn about making money, managing money, saving money – and how to make informed decisions about money. CashCourse is your real-life guide to taking charge of your money. It provides you with the online personal finance tools to help you build real-life-ready financial skills. In addition, you can learn about financial aid basics and research scholarships.

Financial Aid TV (FATV) provides current and prospective students and families with instant 24/7 access to short videos that discuss important financial aid topics such as:

-

Applying for financial aid

-

Financial aid eligibility

-

Types of financial aid (e.g. grants and loans)

-

Financial literacy

-

Satisfactory Academic Progress

-

Veteran’s Information

Why wait in line at the financial aid office? Click on FATV to get quick and easy-to-understand answers to many of your general financial aid questions!

Online Financial Aid Counseling

Online financial aid counseling provides you ways to complete workshops online. You can complete Financial Aid Introduction, Applying for Financial Aid, Student Loan Basics, Private Loan Counseling, Education Tax Benefits, Financial Wellness topics such as Credit Cards, Credit Scoring, Education Tax Benefits, Money Basics, Important Financial Terms, Saving Money, Understanding the Pell Lifetime Eligibility Used (LEU) and its Effects, Information on the 150% Loan Limit Rule, Veterans Post 9/11 GI Bill, Satisfactory Academic Progress [SAP] counseling sessions. Please visit the link above to learn more. .

Register for Selective Service Online

To receive federal student aid, students must be registered with Selective Service if the student is male, at least 18 years old, and born after December 31, 1959.

Moorpark College Online Orientation

Moorpark College is committed to helping you achieve your academic success. We have developed our orientation program to provide you with an introduction and the necessary tools to get you started. This orientation is considered a student’s first counseling contact. Please allow at least one hour to effectively complete this orientation.

As students and their families make important decisions about investing their time and money in pursuing a college education, the California Community Colleges Chancellor’s Office is making available for the first time comparative information about the earnings of recent graduates who received an award in a specific program area at California community colleges.

The Salary Surfer uses the aggregated earnings of graduates from a five year period to provide an estimate on the potential wages to be earned two years and five years after receiving a certificate or degree in certain disciplines. This tool also provides information on which colleges offer programs in those specific disciplines. The Salary Surfer does not contain information about wages earned by community college students who transfer to a four-year institution.

While it is useful to know the potential earnings after receiving a certificate or degree, other important considerations, such as personal interest and skill, should be used in selecting an educational program.

Financial Wellness Cash Course

Your Real-Life Money Guide

When you’re a student, it can feel like money is always tight. You’ve got bills, rent, and tuition to pay, and you want to have enough money for fun, too. So how can you get on the right path to a great financial future, while making your money count today?

CashCourse real-life guide: Take charge of YOUR money

Our online personal finance tools help you build real-life-ready financial skills. Please visit Cash Course to find out more about getting your finances in order and learn about financial aid basics and options.

Step 1: Sign in to your my.vcccd portal

Step 2: Go to the "Registration" Tab on the left side of the screen

Step 3: Select "Register/Add/Drop"

Step 4: Go to "Registration Planner"

Step 5: Select "Edit/Drop Class"

Step 6: Select "Registration Status" for the class you'd like to drop

Step 7: Select "Drop with Refund" from the drop down menu *refunds occur if student drops by the refund deadline date

Step 8: Select "save" to drop the course

GENERAL INFO

Frequently Asked Questions

Is it required for FAFSA applicants to complete the gender question?

Yes, completion of the gender question is required for FAFSA submission. Responses to this question will not impact eligibility for aid and will not be shared with institutions.

-

February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

Is a student able to skip the question on the online application?

No, students cannot skip the gender question on the online FAFSA application. The system requires a response of either "male" or "female" to process the application.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

- NASFAA News, How ED’s Revised Options for Gender on the FAFSA Will Impact the Correction Process

If the question is skipped on either the online application or paper form, can this result in an error and/or flag for verification?

On the online application, the system requires a response to the gender question; thus, skipping it is not possible. For paper FAFSA forms submitted after February 14, 2025, the February 18, 2025 guidance indicates that processing will still occur, "regardless of the answer indicated, and will not require a correction. Institutions do not need to take any action." It is unclear if this is inclusive of instances of skipped entry of Question 11. We recommend for students to answer all questions to the best of their ability to avoid a potential processing error.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

If a student changes their gender selection from one year to the next, can this trigger verification?

The gender/sex question is used for statistical and research purposes by the Department of Education and does not affect aid eligibility. Therefore, discrepancies in gender responses across time would not be a factor for aid distribution or calculation and would not be rationale for verification.

For each award year, the Secretary of Education publishes in the Federal Register a list of the FAFSA information that an institution or applicant may be required to verify. The 2025-26 variant, published, September 9, 2024, does not indicate gender or sex.

- NASFAA News, How ED’s Revised Options for Gender on the FAFSA Will Impact the Correction Process

- FSA Handbook 2025-2026 Application and Verification Guide

- Federal Register, Free Application for Federal Student Aid (FAFSA) Information To Be Verified for the 2025-22026 Award Year

Students and parents are required to create an FSA ID to complete the FAFSA. Does FSA ID require an individual to indicate their gender? And if so, is it required for the FSA ID and FAFSA gender selections to match?

The FSA ID creation process does not have a field for gender or sex. Consequently, there is no requirement for the gender selections on the FSA ID and FAFSA to match.

- FSA Handbook 2025-2026 Application and Verification Guide

- FSA Video Guide, How to Create an Account Username (FSA ID) for StudentAid.gov

- FSA Creating and Using the FSA ID

Are students required to use their legal name for completing a FAFSA?

Yes, students must use their legal name as registered with the Social Security Administration (SSA) when completing the FAFSA. This would be the equivalent as read on the students' social security card. This ensures that the student's information matches SSA records; if there is not a match, this may cause delays and /or the need to correct the input with the SSA.

What if a student already submitted a 2024-25 or 2025-26 FAFSA form before February 14, 2025 indicating "non-binary" or "prefer not to answer" for Question 11?

No action is required by the student or institution, regardless of response to Question 11.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

What if a Student initiates a correction on the 2024-25 or 2025-26 FAFSA form before February 14, 2025?

- If a student attempts to submit a correction for any item on their 2024-25 or 2025-26 form and they previously indicated "Non-binary" or "Prefer not to answer," they will be required to also answer and update Question 11 to resubmit the FAFSA form.

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

What if an INSTITUTION initiates a correction (e.g. verification, professional judgement, etc) to the 2024-25 or 2025-26 FAFSA form from before February 14, 2025?

"Corrections that are initiated by the institutions, regardless of method (FAFSA Partner Portal or EDE), will not require an updated response value to be entered, regardless of the student's previous answer to Question 11."

- February 18, 2025 FSA Electronic Announcement, Implementation of Updated FAFSA Question 11

While the FAFSA form includes responses to the student's gender, race, and ethnicity, these fields are not accessible by the institution nor included in the ISIR. "They are not included in the FAFSA Partner Portal or correctable by the FAA. These fields are included on the FAFSA Submission Summary and are only correctable by the student."

Can I use my financial aid to purchase a computer/laptop?

Yes. Your financial aid can be used to purchase a computer to help you with your educational needs. Did you know you can borrow a laptop thru the lending program administered through the library?

I do not have a laptop for online courses, what can I do? or I need a hotspot?

Moorpark College has a laptop lending program administered through the library. Yes, completion of the gender question is required for FAFSA submission. Responses to this question will not impact eligibility for aid and will not be shared with institutions.

I just completed my financial aid requirements; will I receive financial aid?

It is extremely important that once all requirements are completed, you monitor your portal weekly for updates on your status.

If eligible, an award notification email will be sent to your my.vcccd.edu account once the file review process is complete.

Is it too late to apply for financial aid?

No. We strongly encourage you to apply today! Please visit our website for more information on how to apply.

What happens if I am unable to continue attending school?

We strongly recommend you talk with your instructor(s) before you withdraw from your class(es). We also ask you contact the Financial Aid Office so we can discuss how this will affect your current and/or future financial aid eligibility. Lastly, we recommend you speak to your academic counselor and the Admissions and Records Office to discuss any other alternatives that may be available.

Will I have to repay my financial aid if I stop attending, completely withdraw or fail all of my classes this semester?

If you stop attending, completely withdraw or fail all of your courses you may not be eligible for the full amount of financial aid funds that you were originally scheduled to receive. The Financial Aid Office will determine the amount of aid you have “earned” and/or the amount you may owe. See Return of Title IV Funds (R2T4) for more information.

- How do I apply for financial aid?

- Who's my parent?

- What is a California College Promise Grant ?

- What are grants?

- What are financial need, Cost of Attendance (COA), and Expected Family Contribution?

- How do I know if am a Dependent or Independent student?

- What is Work-Study?

- Did you know?

- How do I communicate with the Moorpark College Financial Aid Office?

We recommend you regularly check your MyVCCCD student portal for updates or changes to your financial aid.

We offer programs and services to help meet some of your educational costs. Financial aid applications are accepted throughout the academic year but we encourage you to apply as soon as possible.

The Financial Aid Office is comprised of dedicated financial aid professionals committed to serving students and provide them information to secure the necessary financial resources to meet their educational objectives. Financial aid awards are subject to availability of funds, eligibility for funds, enrollment status and financial need.

-

Provide student centered service, information, and identify financing options to students seeking financial assistance

-

Maintain efforts to minimize the student loan default rate

-

Identify, outreach to, and increase both financial aid participation and student access to locally defined un-served, under-served, and DI student populations

-

Increase awareness on campus and at local high schools of financial aid

Students learning outcomes:

-

Students who attend an application assistance session will learn how to complete & submit applications, and meet deadlines.

-

Students who complete online SAP counseling session will demonstrate knowledge and understanding of the Satisfactory Academic Progress "SAP" standards for maintaining financial aid eligibility and apply that knowledge to their academic situation and/or circumstances.

-

Students who take out a loan will gain understanding of the requirements, rights and responsibilities, and repayment obligations associated with acquiring a federal student loan.

Moorpark College Mission

Grounded in equity, social justice, and a students first philosophy, Moorpark College values diverse communities. We empower learners from local, national, and global backgrounds to complete their degree, certificate, transfer, and career education goals. Through innovation and customized student support, our programs are designed to achieve equitable outcomes